Trend Following The Nifty Index

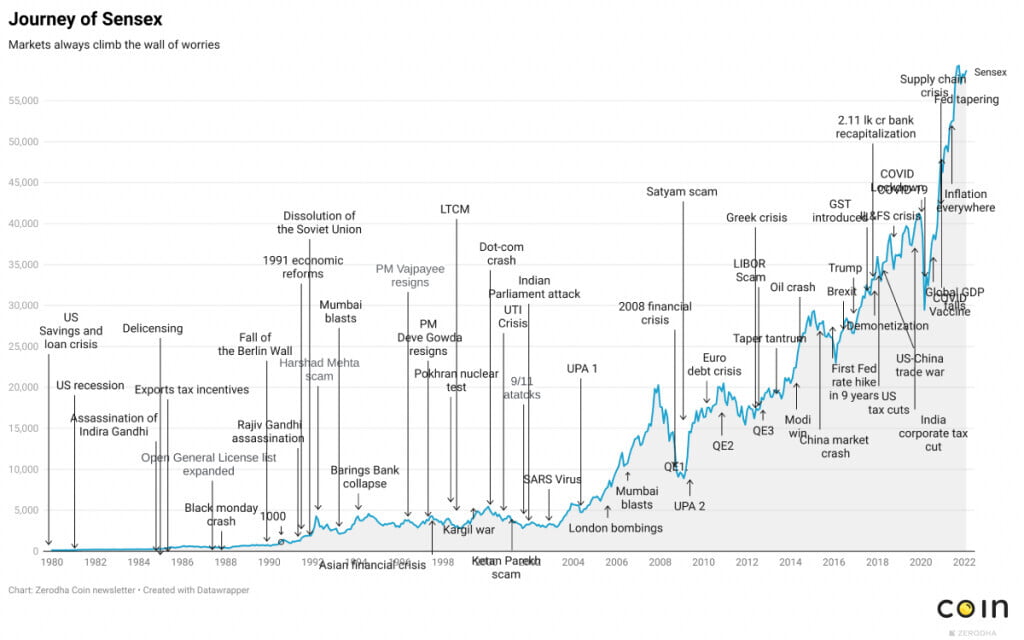

Trend following is a viable trading strategy. Globally all markets trend around 30-35% of the time. If we can detect the onset of a trend and then ride that trend, substantial profit can be generated. Accuracy is low but the trending periods generate enough income to substantially override the drawdown phases. However, choice of the right instrument is super important in trend following strategies. We need instruments that are likely to trend rather than stay side ways or volatile for a long period of time. In the context of Indian markets, Nifty is the ideal candidate for trend following. As you can see from the pic here posted on Zconnect Indian markets are on a long term uptrend. But there will always be events to pull it down.

Barring any catastrophic events, India will regain its lost glory from the darkness of its colonial past. There was a time when India was called “the sink of the world’s gold!” (Pliny the Elder, in 77 CE) which lasted till the point it was looted away. The long term up trend with the event driven down trends shall present profitable turns for a trend following strategy. Also, Nifty derivatives are among the most liquid tradeable instruments in the market. This liquidity helps reduce trade slippage and also makes it is difficult for lone players to move Nifty in either direction. Our flagship product TrendShikari NTS hence analyses Nifty to power strategies with quality directional signals.